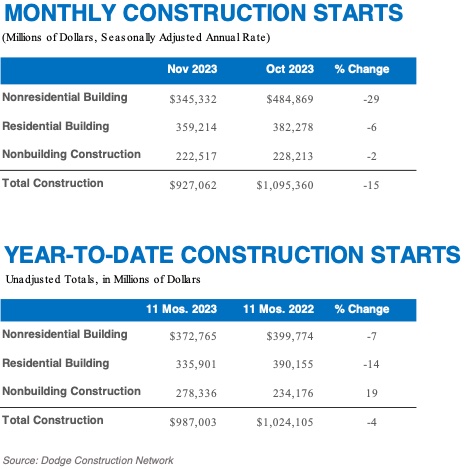

Total construction starts fell 15% in November, dropping to a seasonally adjusted annual rate of $927 billion, according to Dodge Construction Network. Nonresidential building starts fell 29% during the month, residential starts lost 6%, and nonbuilding starts dropped 2%.

Year-to-date through November 2023, total construction starts lagged by 4% compared to the previous year. Residential and nonresidential starts were down 14% and 7%, respectively, but nonbuilding starts were up 19%.

“Construction starts are deeply feeling the impact of higher rates,” Richard Branch, chief economist for Dodge Construction Network, said in a Dec. 20 statement.

“While the Federal Reserve seems poised to start cutting rates in the New Year, the impact on starts will lag. As a result, starts are expected to be weak through the mid-point of 2024 before growth resumes.”

“While the Federal Reserve seems poised to start cutting rates in the New Year, the impact on starts will lag. As a result, starts are expected to be weak through the mid-point of 2024 before growth resumes.”

Nonbuilding

Nonbuilding construction starts in November fell 2%, amounting to a seasonally adjusted $223 billion. Highway and bridge starts decreased 8%, environmental public works starts fell 4%, utility/gas starts rose 17%, and miscellaneous nonbuilding starts improved by 1%.

Year-to-date through November, nonbuilding starts were up 19% overall. Utility/gas plants rose 49%, and miscellaneous nonbuilding starts increased 18%. Highway and bridge starts gained 9%, and environmental public works rose 11%.

The largest nonbuilding projects to break ground in November were the $834 million I-405 Brickyard to SR 527 improvements in Bothell, Washington, the $406 million second phase of the Sherco Solar Farm in Becker, New Mexico, and a $353 million addition to the Silverhawk Generating Station in Moapa, Nevada.

Nonresidential

Nonresidential building starts decreased 29% in November to a seasonally adjusted annual rate of $345 billion. Manufacturing starts plummeted 74% following a strong several strong project starts in October. Commercial starts fell 19% with office buildings being the only category to see a gain. Institutional starts rose 7% due to a significant uptick in healthcare activity. Year-to-date through November, total nonresidential starts were 7% lower than in 2022. Institutional starts gained 5%, while commercial and manufacturing starts fell 13% and 18%, respectively.

The largest nonresidential building projects to break ground in November were the $1.9 billion Children’s Hospital of Philadelphia Inpatient Tower in Pennsylvania, the $1.6 billion LG Energy Battery Plant in Queen Creek, Arizona, and the $750 million expansion of the Iowa Army Ammunition Plant in Middletown, Iowa.

Residential

Residential building starts declined 6% in November to a seasonally adjusted annual rate of $359 billion. Single family starts increased 1%, while multifamily starts fell 19%. Year-to-date through November 2023, total residential starts were down by 14%, with single-family starts dropping 15% and multifamily starts by 12%.

The largest multifamily structures to break ground in November were the $200 million 55 Broad Street residential conversion in New York City, the $200 million redevelopment of The Superman Building in Providence, Rhode Island, and the $185 million Union West mixed-use development in Raleigh, North Carolina.

Regionally, total construction starts in November fell in the Midwest, South Atlantic, South Central and West regions, but rose in the Northeast.